Primary stakeholders of Shuaa Capital PSC are currently in preliminary discussions about reducing their ownership in the investment bank located in Dubai. This could provide an opportunity for new investors to enter one of the most longstanding financial entities in the Gulf.

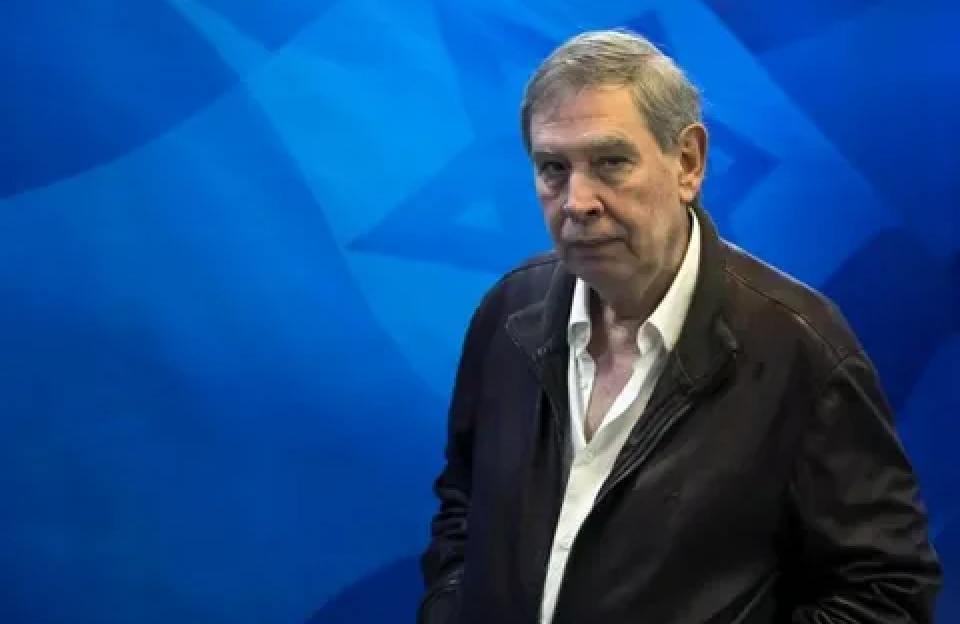

The bank’s Managing Director, Jassim Alseddiqi, who holds around 25% of the shares, is considering decreasing his stake as he plans to transition to a role in technology, academia, and research. Similarly, other significant shareholders are contemplating a reduction in their stakes.

Alseddiqi conveyed his intentions of reconfiguring his ownership in Shuaa Capital on LinkedIn, emphasizing his shifting professional priorities and making room for new investors. Insiders have revealed that these primary shareholders, who together control over 50% of the bank’s shares, are discussing potential strategies with advisers like Lazard Ltd. They prefer a consolidated strategic investor or a group, but they may decide to retain some or all of their shares.

Both Shuaa and Lazard representatives were not immediately reachable for a statement. Established in 1979, Shuaa Capital has taken part in significant deals, like DP World’s $5 billion IPO in Dubai in 2007. The institution has experienced various changes in structure, ownership, and leadership in the past. Lately, Shuaa Capital has been on a mission to fortify its investment banking wing, bringing onboard ex-bankers from Credit Suisse. With a market valuation surpassing 1 billion dirhams ($272 million), the firm manages assets nearing $5 billion.